Here’s something most people don’t realize: you can actually get paid to go to college. Or at the very least, graduate without owing a dime. While plenty of students are drowning in six-figure debt, others are walking away with degrees—and money in their pockets.

Sounds too good to be true? It’s not. Work-colleges like Berea cover 100% of tuition and pay students to work on campus. Tuition-free universities like University of the People charge only small assessment fees. And if you qualify for enough grants at an affordable school, you might get a refund check every semester.

This guide breaks down exactly how these programs work, who qualifies, and how to put yourself in the best position to access them. We’ve dug into the actual numbers—verified against federal databases, institutional websites, and IRS guidelines—so you’re not just reading hype.

What you’ll find in this guide:

- 20+ schools that cover full tuition (or actually pay you)

- How to get up to $7,395/year in Pell Grants (free money, no repayment)

- Work-study jobs that pay $2,000-$6,000 annually

- The $5,250 tax-free benefit your employer might already offer

- Step-by-step FAFSA instructions (it’s not as complicated as you think)

- Which schools are legit and which to avoid

This isn’t just for high school seniors. These programs work for working adults going back to school, career changers, single parents, veterans, and anyone who’s been told college “isn’t affordable” for people like them.

Sources: Federal Student Aid (studentaid.gov), U.S. Department of Education, institutional financial aid offices, IRS Publication 970, Bureau of Labor Statistics.

Online Colleges Pay You to Attend – Fact or Fiction?

Let’s clear something up right away: “getting paid to attend college” isn’t a scam or some weird loophole. It happens through legitimate financial aid mechanisms that have existed for decades. The trick is knowing how to access them.

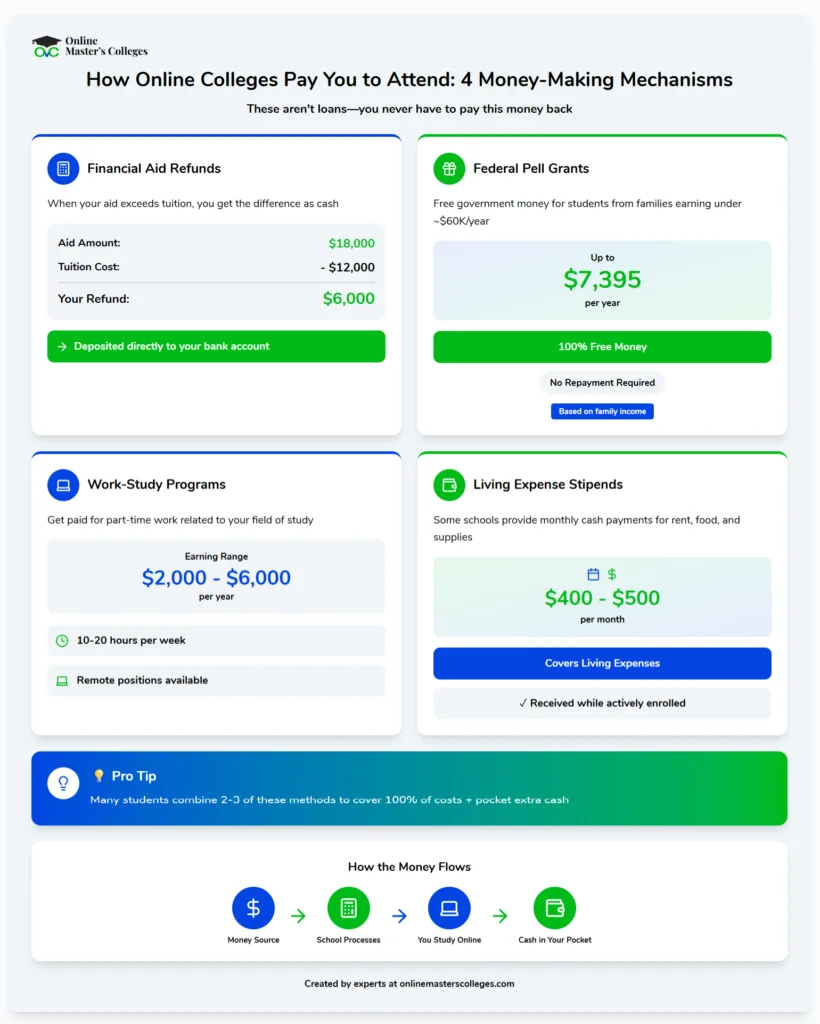

There are basically four ways students end up with more money than they owe:

- Their grants exceed tuition, so the school sends them a refund check

- They work a campus job through work-study and earn wages

- They attend a work-college that pays them directly

- Their school provides a living stipend on top of tuition coverage

Most of these require demonstrating financial need—which basically means your family doesn’t have a ton of money. That’s not a barrier; it’s actually your ticket in. Let’s dig into each option.

How Online Colleges Pay You to Attend: 4 Money-Making Mechanisms

Understanding how each mechanism works helps you figure out which path makes sense for your situation. Here’s a quick comparison:

| Mechanism | How It Works | Typical Amount | What You Need |

|---|---|---|---|

| Financial Aid Refund | Grants exceed tuition; school sends you the extra | $500-$3,000/semester | Low-cost school + strong grants |

| Pell Grant | Federal grant you don’t pay back | Up to $7,395/year | FAFSA + financial need |

| Work-Study | Part-time campus job, paid hourly | $2,000-$6,000/year | FAFSA + available positions |

| Stipends | Monthly cash beyond tuition | $400-$1,500/month | Specific schools (often work required) |

Financial Aid Refund Checks: Getting Cash Back When Aid Exceeds Tuition

This is probably the most common way students “get paid” for college, though it’s a bit misleading. What’s actually happening: your total financial aid (Pell Grant + state grants + scholarships + loans) adds up to more than your tuition bill. The school takes what it’s owed and sends you the rest.

That leftover money isn’t a bonus—it’s meant to cover living expenses like rent, food, books, and transportation. But if you’re living cheaply or have other income, it can feel like getting paid to go to school.

Important caveat: If part of your aid package includes loans, remember that’s borrowed money you’ll eventually repay. The “free money” portion comes only from grants and scholarships.

How Refunds Are Calculated and When You Receive Them

The math is simple: Total Financial Aid minus Direct Charges equals your refund.

“Direct charges” means what the school actually bills you—tuition, fees, and room/board if you live on campus. The school doesn’t charge off-campus rent, groceries, and gas, but they’re included in your Cost of Attendance calculation (which determines how much aid you can receive).

Most schools disburse refunds 2-4 weeks into the semester, after the add/drop deadline passes. Set up direct deposit if you want the money fast—paper checks can take an extra week or two to arrive.

Typical Refund Amounts by Income Level

Your refund depends on how much aid you get versus what your school costs. Students at community colleges or affordable state schools typically see the biggest refunds.

| Family Income | Typical Aid Package | Refund at $10K School |

|---|---|---|

| Under $30,000 | $7,395 Pell + $3,000-$5,000 other grants | $2,000-$4,000+/year |

| $30,000-$60,000 | $2,000-$6,000 Pell + $1,000-$3,000 other | $500-$2,500/year |

| $60,000-$80,000 | $0-$2,000 Pell + institutional grants | Depends on the school |

Federal Pell Grants: Up to $7,395 in Free Money Annually

The Pell Grant is the foundation of financial aid for low-income students. Unlike loans, you never pay it back. For the 2024-2025 and 2025-2026 school years, the maximum award is $7,395.

You can receive Pell Grants for up to 12 semesters total—roughly 6 years of school. And here’s something a lot of people miss: if you take summer classes, you might qualify for “year-round Pell,” which can bump your annual award up to 150% of the normal amount.

Pell Grant Eligibility Requirements (Income and SAI)

Your Pell eligibility comes down to your Student Aid Index (SAI), which the government calculates from your FAFSA. Here’s how it breaks down:

- SAI of 0 or negative = Maximum Pell ($7,395)

- Positive SAI under $7,395 = Calculated Pell (max Pell minus your SAI)

- Minimum Pell = $740 (for students who barely qualify)

Rough income guidelines: Families earning under $30,000 usually get the maximum Pell. Those earning $30,000- $60,000 receive partial Pell. For amounts above $60,000, it depends heavily on family size and other factors. Don’t assume you won’t qualify—file the FAFSA and find out.

How to Apply for Pell Grants Through FAFSA

There’s no separate application for the Pell Grant. You automatically get considered when you submit your FAFSA at studentaid.gov. The form opens on October 1 each year for the following school year.

Here’s what you need to do:

- Create an FSA ID at studentaid.gov (your parent needs one too if you’re under 24)

- Gather your documents: Social Security number, tax returns, W-2s, bank statements

- Use the IRS Data Retrieval Tool—it pulls your tax info directly and reduces errors

- List up to 20 schools (they’ll all get your info)

- Submit early—some state aid is first-come, first-served

Work-Study Programs: Earning $2,000-$6,000 While Studying Online

Federal Work-Study gives you a part-time job—usually on campus—where you earn actual wages. The money goes straight to you (not your tuition bill), so you can use it however you want.

Two big perks make work-study better than a regular job:

- Your earnings don’t count against you on next year’s FAFSA (regular job income does)

- You don’t pay Social Security taxes on work-study wages

Finding Remote Work-Study Positions

If you’re an online student, traditional on-campus work-study doesn’t help much. But many schools expanded remote options during COVID, and some have kept them. Common remote positions include:

- Online tutoring for other students

- Virtual help desk or tech support

- Data entry and administrative work

- Social media management

- Research assistance for professors

Contact your financial aid office directly to ask what’s available. Remote positions fill fast, so don’t wait until the semester starts.

How Work-Study Earnings Don’t Affect Financial Aid

This is a big deal that most students don’t understand. If you earn $5,000 at Starbucks, that income shows up on your FAFSA next year and could reduce your aid. But if you earn $5,000 through work-study, it doesn’t count against you.

Typical earnings: Most work-study students work 10-15 hours per week at $12-$18/hour (varies by state and position). Over a 30-week school year, that’s roughly $3,600-$8,100—though your actual award might cap your total earnings.

Stipends and Living Expense Coverage: Monthly Cash Payments

A handful of schools go beyond covering tuition—they actually give students monthly spending money. These programs are rare, but they exist.

Schools That Offer Direct Stipends

Deep Springs College is the gold standard here. Every student receives full tuition, room, and board (worth $50,000+/year), and the school covers books and travel for students who need them. The catch? You work 20 hours a week on a cattle ranch in the California desert, and only about 14 students get in each year.

Berea College requires 10-15 hours of campus work per week, and students earn real wages (around $2,000 in the first year) in addition to their full-tuition scholarship. You graduate with work experience and money in the bank, not debt.

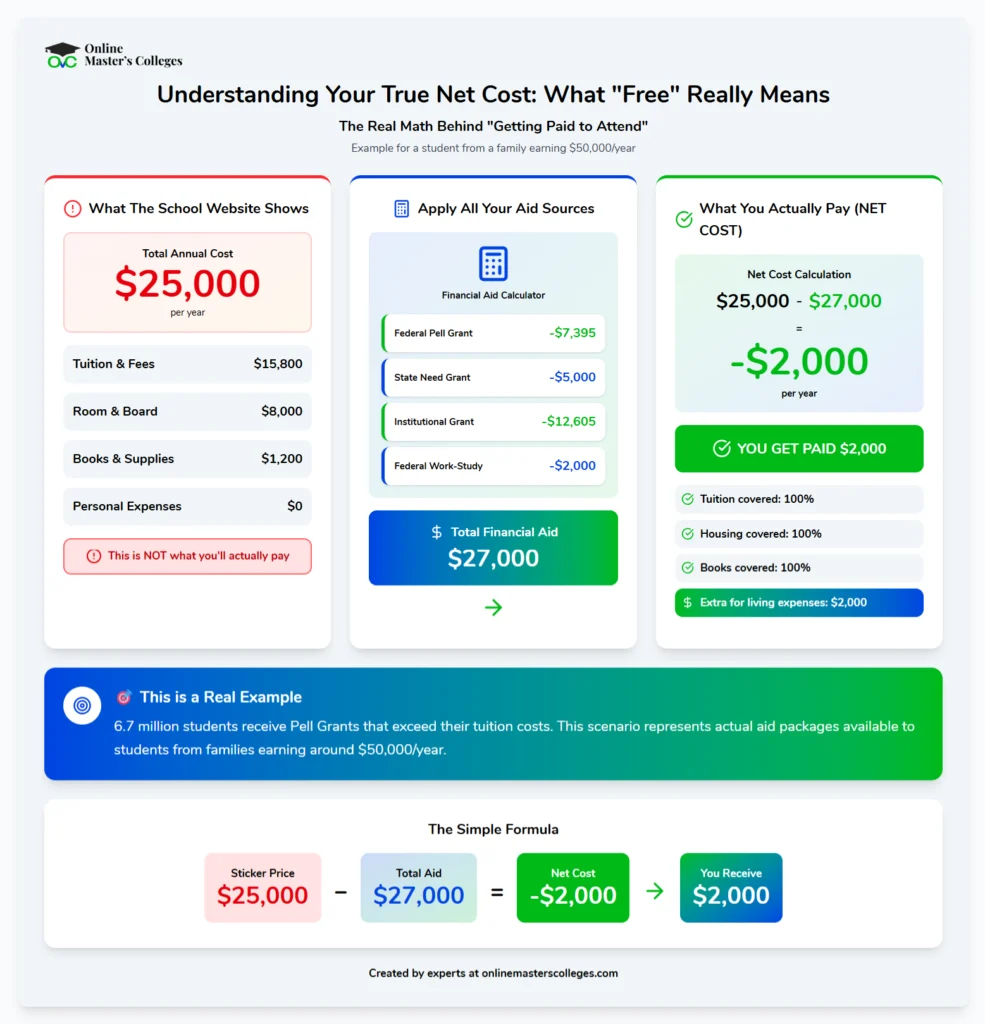

Understanding Your True Net Cost: What “Free” Really Means

“Free college” gets thrown around a lot, but it’s worth understanding what that actually means in practice. Spoiler: there’s usually some fine print.

Total Cost of Attendance: Direct vs. Indirect Expenses

Your Cost of Attendance (COA) includes everything you’ll spend during a school year. It breaks into two buckets:

Direct costs (what the school charges you):

- Tuition and fees

- Room and board (if you live on campus)

Indirect costs (what you spend, but not on the school):

- Rent and food (if you live off-campus)

- Books, supplies, laptop

- Transportation

- Personal expenses

When a school says “free tuition,” they usually mean they’re covering the direct costs. You might still need to figure out rent and food on your own—though your financial aid refund can help with that.

Calculating Net Cost After All Aid

Net cost = what you actually pay after grants and scholarships. Here’s the formula:

Total Cost of Attendance – Grants and Scholarships = Net Cost

If your net cost is negative, you get a refund check. Example: School costs $20,000. You receive $24,000 in grants, resulting in a $4,000 refund.

When “Full Tuition” Becomes “Getting Paid”

You transition from “free school” to “getting paid” when your grant aid exceeds your direct costs. This usually happens when:

- You choose an affordable school (community college, in-state public university)

- You qualify for maximum Pell ($7,395)

- You receive state grants on top of federal aid

- You live off-campus (so room/board isn’t charged by the school)

- You stack outside scholarships on top of institutional aid

20+ Online Colleges That Cover Full Tuition (Or More)

Now for the part you actually came for: specific schools where you can get your education covered—or walk away with money. Every program listed here has been verified for accreditation and current availability.

Work-Colleges With 100% Tuition Coverage + Earnings

Work-colleges are a unique model: you work as part of your education, and in exchange, you don’t pay tuition. It’s not charity—you’re earning your way. And you graduate with real job experience.

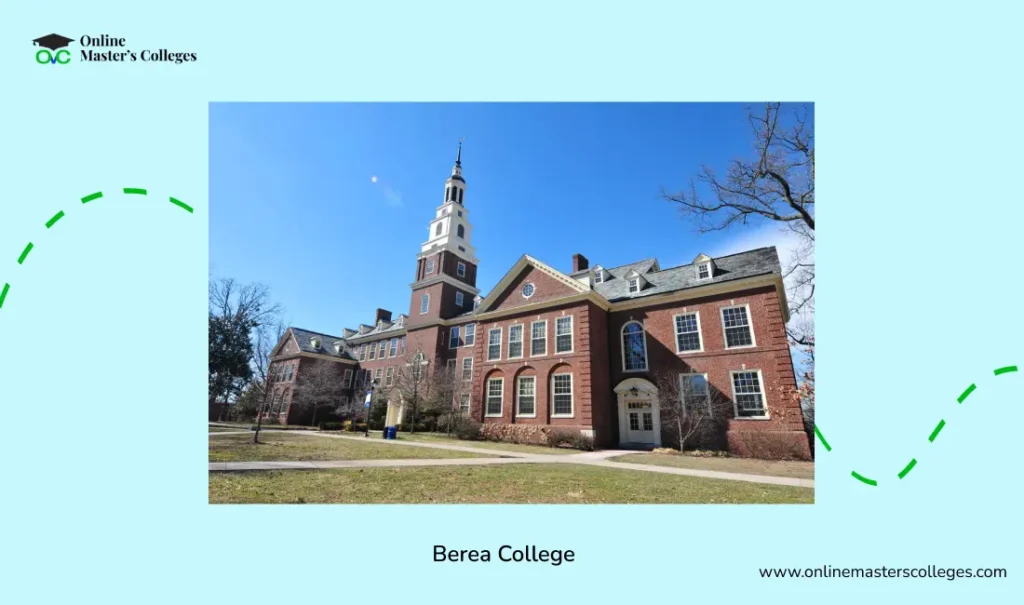

Berea College: $200,000+ in Scholarship Value + Paid Work

Berea College in Kentucky is the only four-year school in America where every student receives 100% tuition coverage. Not most students. All of them. The Tuition Promise Scholarship is worth over $200,000 across four years.

The deal:

- Full tuition covered ($45,000+/year value)

- You work 10-15 hours/week in a campus job

- First-year students earn about $2,000 for personal expenses

- Room and board assistance available based on need

- Regionally accredited by SACSCOC

Who gets in: You need to demonstrate financial need—generally, families in the bottom 40% of U.S. income. About 75% of students come from Appalachia. The acceptance rate is around 25%, so it’s competitive. International students can apply too (about 8% of the student body).

Barclay College: Full Tuition for Students Living on Campus

Barclay College is a small Christian school in Kansas that offers full tuition scholarships to all residential students. If you live on campus, you don’t pay tuition—period.

What you get:

- Full tuition scholarship (~$26,590 value) for dorm residents

- Extra $1,000/year if you have a 3.5+ GPA (President’s Scholar Award)

- Room and board costs reduced for 2024-2025

- Pell Grant eligible (stack it on top)

- Accredited by the Higher Learning Commission

Programs include Biblical Studies, Business Management, Psychology, and Pastoral Ministries. They also offer online programs, but the full-tuition deal is available only to residential students.

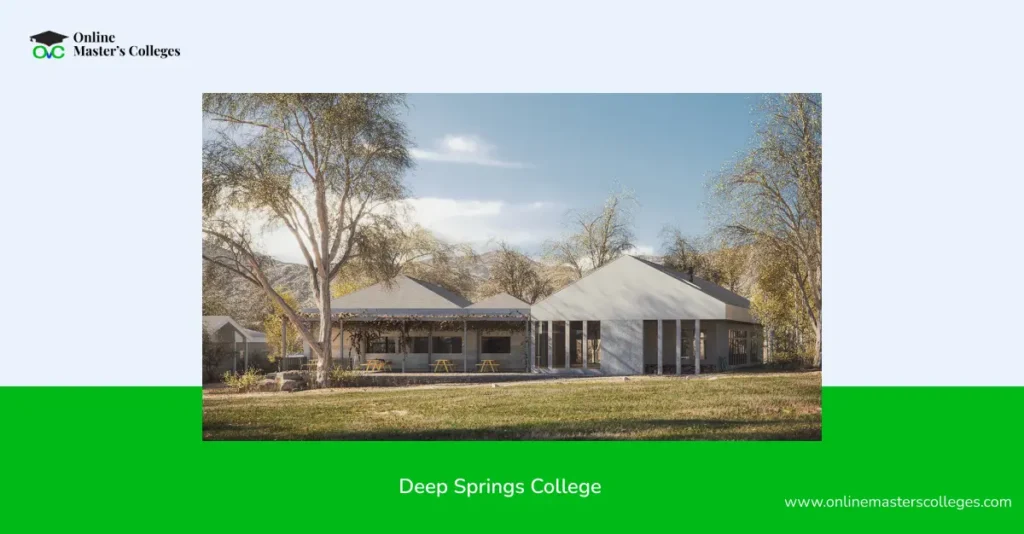

Deep Springs College: Everything Covered + Ranch Work Experience

Deep Springs is unlike any other college in America. It’s a two-year program on a cattle ranch in the California desert where everyone gets a full scholarship—tuition, room, board, everything. If you have financial needs, they’ll cover your books and travel too.

The program:

- Full scholarship worth $50,000+/year for ALL students (need-blind)

- You work 20 hours/week—herding cattle, fixing fences, cooking meals

- Students help govern the college (you’ll be on hiring committees, etc.)

- 95%+ of graduates complete bachelor’s degrees after transferring

- Only 14 students admitted per year (extremely selective)

It’s not for everyone—you’re living in isolation on a ranch. But if that appeals to you, it’s one of the best deals in higher education.

Tuition-Free Online Universities

These schools don’t charge tuition at all. You’ll pay small fees, but nothing like traditional college costs.

University of the People: No Tuition, Just Small Fees

University of the People (UoPeople) is the world’s first tuition-free, accredited online university. Over 150,000 students from 200+ countries are enrolled, and many would never have been able to afford traditional college.

What it actually costs:

- Tuition: $0

- Application fee: $60 (one-time)

- Assessment fees: $120/course (undergrad) or $240/course (grad)

- Total for a bachelor’s degree: roughly $4,860

- Scholarships are available if you can’t afford the fees

Here’s the big news: In February 2025, UoPeople received full WSCUC accreditation—that’s the same regional accreditor that covers Stanford, UCLA, and Berkeley. They also hold DEAC accreditation. This is legit.

Programs offered: Business Administration, Computer Science, Health Science (associate/bachelor’s), plus MBA, IT, and Education master’s degrees.

Elite Universities With Generous Income Thresholds

These aren’t primarily online schools, but their financial aid policies are worth knowing about. If your family earns under certain thresholds, you pay nothing for tuition.

Columbia University: Free for Families Under $150K

Columbia’s financial aid is genuinely impressive. If your family earns under $150,000 with typical assets, you don’t pay tuition. Under $66,000? Your parents don’t contribute anything toward your education.

The numbers:

- Under $150K income = tuition-free

- Under $66K income = $0 parent contribution

- Average grant: $76,265

- 51% of freshmen receive Columbia grants

- No loans in financial aid packages

- $2,000 start-up grant for low-income students

Other Elite Schools With Free Tuition Thresholds

Competition is fierce, but if you can get in, these schools make it affordable:

| School | Free Tuition If Under | Notes |

|---|---|---|

| Harvard | $200,000 (starting 2025-26) | No loans required |

| MIT | $200,000 | Need-blind admissions |

| Princeton | $160,000 | Covers room & board too |

| Brown | $125,000 | Under $60K = all costs covered |

| Dartmouth | $125,000 | No loans |

| Yale | $75,000 | Full need met |

| Cornell | $75,000 | No parent contribution |

Who Qualifies: Eligibility Requirements for Full-Aid Programs

Different programs have different requirements. Here’s what you need to know about qualifying.

Income Thresholds by Program Type

| Program | Max Benefit Threshold | Partial Benefit Range | Key Factor |

|---|---|---|---|

| Federal Pell (Maximum) | SAI of 0 or negative | SAI up to $7,395 | Student Aid Index |

| Elite University Aid | $125K-$200K | Sliding scale | Income + assets |

| State Promise Programs | $60K-$125K | Varies by state | Residency + income |

| Work-Colleges | Bottom 40% income | N/A | Demonstrated need |

FAFSA: Your Gateway to All Financial Aid

Almost every financial aid program requires the FAFSA. If you do nothing else, file this form. It’s free, it takes about an hour, and it unlocks billions of dollars in aid.

Step-by-Step FAFSA Filing Guide

Here’s exactly what to do:

- Step 1: Create FSA IDs at studentaid.gov. Student needs one; parent needs a separate one if student is under 24.

- Step 2: Gather tax returns, W-2s, bank statements, and Social Security numbers.

- Step 3: Start the FAFSA at studentaid.gov (opens October 1 for the following year).

- Step 4: Use the IRS Data Retrieval Tool to import tax info automatically.

- Step 5: List your schools (up to 20)—they’ll all receive your info.

- Step 6: Submit before state priority deadlines (usually January-March).

Understanding Your Student Aid Index (SAI)

Your SAI (replaced the old “EFC” in 2024) is a number that determines your aid eligibility. Lower is better. Here’s what matters:

- SAI can now go negative (down to -1500)—that actually helps you

- Zero or negative SAI = maximum Pell Grant

- It’s an INDEX, not a dollar amount—don’t assume your SAI equals what you’ll pay

GPA and Academic Requirements

Need-based aid has minimal academic requirements. Merit scholarships are a different story.

Minimum GPAs for Need-Based Aid

To keep receiving federal aid, you need to maintain “Satisfactory Academic Progress”:

- 2.0 cumulative GPA (basically a C average)

- Complete at least 67% of attempted credits

- Finish your degree within 150% of the expected timeframe

These are minimums—you won’t lose Pell Grants for getting B’s instead of A’s.

How to Apply and Maximize Your Aid Package

Getting the most money requires strategy, not just paperwork. Here’s how to position yourself for maximum aid.

Application Timeline: Start 12-18 Months Early

If you’re planning for Fall 2026 enrollment, here’s your schedule:

Spring 2025 (12+ months out):

- Research schools using Net Price Calculators

- Start hunting for private scholarships

- Create your FSA ID

October 1, 2025:

- FAFSA opens—submit ASAP (state aid often runs out)

January-March 2026:

- Most state and school deadlines hit

- Submit the CSS Profile if your schools require it

Scholarship Stacking: Combining Multiple Sources

You can combine federal, state, institutional, and private scholarships—but there’s a cap. Your total aid can’t exceed your Cost of Attendance.

If you end up with more aid than your COA allows, schools reduce your package. Usually, loans get cut first (good news), then work-study. Pell Grants are protected—they’re the last thing reduced.

Employer Tuition Reimbursement: $5,250 Tax-Free

Here’s a benefit many employees completely overlook: under IRS Section 127, your employer can give you up to $5,250 per year for education—tax-free. You don’t pay income tax on it. It covers tuition, fees, books, and supplies.

The courses don’t even need to be job-related. Your employer can pay for you to get a degree in something completely different from your current job.

Check with your HR department. A surprising number of companies offer this but don’t advertise it.

Evaluating Award Letters: Spotting the Real Deal

When colleges send award letters, they don’t always make it easy to compare. Some schools call loans “awards” to make their packages look bigger. Here’s how to see through the marketing.

Grants vs. Loans vs. Work-Study: Know the Difference

Free money (you keep it):

- Pell Grant, FSEOG, state grants

- Institutional scholarships and grants

- Private scholarships

Borrowed money (you pay it back with interest):

- Federal Direct Loans (subsidized and unsubsidized)

- Parent PLUS Loans

- Private loans

Earned money (you work for it):

- Work-study (not guaranteed until you earn it)

Negotiating Your Financial Aid Package

Yes, you can negotiate financial aid. It’s called “appealing” your award, and schools expect some students to do it.

When and How to Appeal

You have grounds to appeal if:

- Your income dropped since filing FAFSA (job loss, reduced hours)

- You have large medical bills or other unusual expenses

- Your family situation changed (divorce, death, separation)

- Another comparable school offered you more (mention this respectfully)

How to do it: Contact the financial aid office, explain your situation in writing, and provide documentation. Be polite, specific, and honest. They deal with thousands of students, making their job easy.

Work-Study Deep Dive: Earning While Learning

If you want to earn money in college without hurting next year’s financial aid, work-study is your best bet.

Federal Work-Study vs. Institutional Work Programs

| Feature | Federal Work-Study | Work-College Programs |

|---|---|---|

| Who qualifies | Based on financial need (FAFSA) | Often required for all students |

| Hours | 10-15/week (flexible) | 10-20/week (mandatory) |

| Impact on future aid | Earnings excluded from FAFSA | Varies by school |

How Much Can You Actually Earn?

Here’s what typical work-study earnings look like:

| Hours/Week | Wage | Weeks/Year | Total Earnings |

|---|---|---|---|

| 10 | $12 | 30 | $3,600 |

| 15 | $12 | 30 | $5,400 |

| 10 | $15 | 30 | $4,500 |

| 15 | $15 | 30 | $6,750 |

Graduating Debt-Free: It’s Actually Possible

The average student loan debt is over $30,000. That’s about $300/month for 10 years. Graduating debt-free is like giving yourself a $300/month raise before you even start your career.

Covering 100% of Costs With Free Aid

The formula: Choose a school where (Pell + State Grant + Institutional Aid) ≥ Cost of Attendance

Example for a student with maximum Pell at a community college:

| Aid Source | Amount |

|---|---|

| Federal Pell Grant | $7,395 |

| State Grant | $3,000 |

| College Grant | $2,000 |

| Total Free Aid | $12,395 |

| Community College COA | $10,000 |

| Your Refund | $2,395 |

Using Refund Checks for Living Expenses

When your grants exceed tuition, budget that refund carefully:

- Rent and utilities

- Groceries (not eating out every day)

- Textbooks and supplies

- Computer, if you need one

- Transportation to campus or work

If your refund includes loan money, remember: that’s borrowed cash. Don’t spend loans on spring break trips.

Return on Investment: Are These Schools Worth It?

Free doesn’t automatically mean good. Let’s look at actual outcomes.

Graduation Rates at Full-Aid Schools

| School | 6-Year Graduation Rate |

|---|---|

| Columbia University | 95%+ |

| Deep Springs (transfer to 4-year) | 95%+ complete bachelor’s |

| Berea College | 64% |

| National Average | 62.2% |

Are “Free” Schools Lower Quality?

Short answer: No—if they’re properly accredited.

Every school in this guide holds legitimate accreditation:

- Berea: SACSCOC (regional)

- University of the People: WSCUC (regional, as of Feb 2025) + DEAC

- Deep Springs: ACCJC

- Barclay: Higher Learning Commission

Regional accreditation is what matters most to employers and grad schools. It’s the standard.

Frequently Asked Questions

Can I really get paid to go to college, or is this a scam?

It’s real, but “getting paid” usually means one of two things: (1) your grants exceed your tuition so you get a refund check, or (2) you work a job on campus through work-study. Nobody’s handing out free money with no strings. You either need to demonstrate financial need, attend a low-cost school, or work for it. But yes, many students finish each semester with money left over.

What’s the maximum Pell Grant for 2025-2026?

Do I need perfect grades to qualify for these programs?

Is University of the People legitimate?

How do I get a financial aid refund check?

What if my family earns too much to qualify for Pell Grants?

Can online students get work-study jobs?

Will getting outside scholarships reduce my financial aid?

What’s the difference between FAFSA and CSS Profile?

Can I negotiate my financial aid package?

Action Plan: What to Do Next

Information doesn’t help unless you act on it. Here’s your checklist.

Do This Month

- Create your FSA ID at studentaid.gov (do it today—it takes 1-3 days to activate)

- Gather financial documents: last year’s tax return, W-2s, bank statements

- Identify 3-5 affordable schools and run their Net Price Calculators

- Ask your employer about tuition assistance benefits

Do in the Next 3-6 Months

- Submit FAFSA as soon as it opens (October 1)

- Apply to schools before their financial aid priority deadlines

- Apply for 5-10 private scholarships (even small ones add up)

- Submit the CSS Profile if any of your schools require it

Do 6-12 Months Before Enrollment

- Compare award letters (look at net cost, not gross aid)

- Appeal packages if you have grounds

- Set up direct deposit for refunds

- Apply for work-study positions early (best jobs go fast)

- Create a budget for how you’ll use any refund money

The Bottom Line

College doesn’t have to mean debt. Plenty of people are earning degrees right now without borrowing a penny—or even pocketing extra money. The programs exist. The question is whether you’ll take the steps to access them.

Start with the FAFSA. Apply early. Choose schools where your aid can actually cover your costs. And don’t be afraid to ask for more—financial aid offices expect appeals, and they have money set aside for students who make a good case.

Your debt-free degree is possible. Now go get it!

Looking for more options? Check out our complete guide to online degree programs to find the right fit for your goals.